Get the latest insights on price movement and trend analysis of Lithium Carbonate in different regions across the world (Asia, Europe, North America, Latin America, and the Middle East & Africa). This comprehensive report delves into the fluctuating landscape of lithium carbonate prices, examining key factors influencing market trends and providing valuable forecasts for stakeholders and industry players.

Request For Free Sample: https://www.procurementresource.com/resource-center/lithium-carbonate-price-trends/pricerequest

Definition of Lithium Carbonate

Lithium carbonate (Li2CO3) is an inorganic compound, a white salt primarily derived from spodumene and lithium-rich brine pools. It is one of the pivotal lithium compounds used in the production of various lithium-ion batteries, which power a vast array of modern devices, including electric vehicles (EVs), smartphones, and energy storage systems. The increasing demand for sustainable energy solutions has significantly heightened the importance of lithium carbonate in global markets.

Key Details About the Lithium Carbonate Price Trend

Historical Price Trends

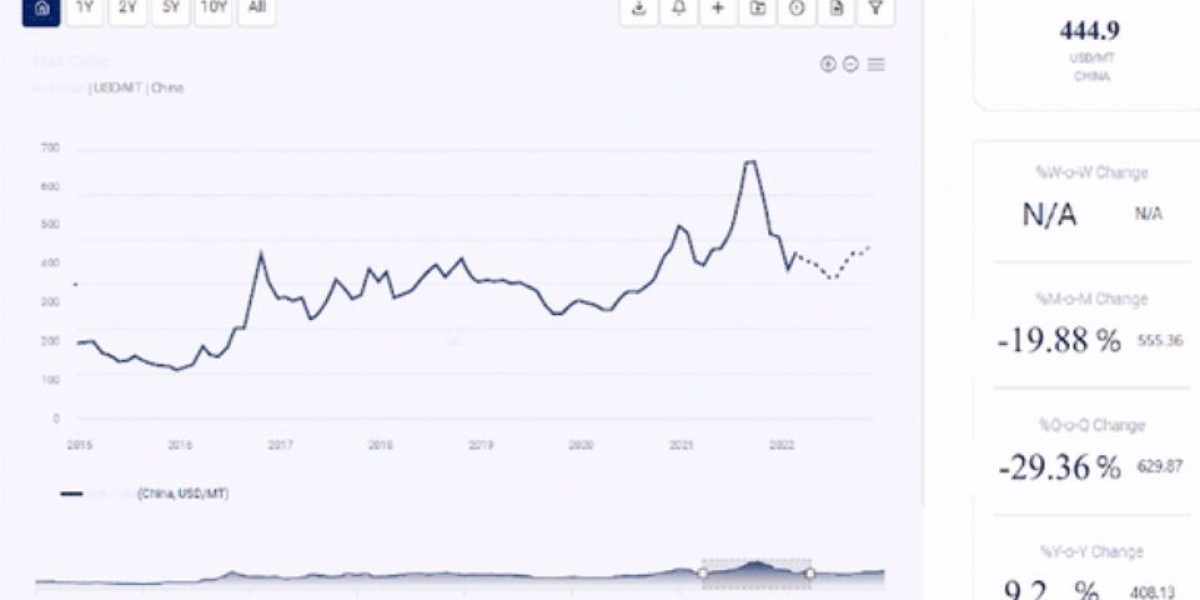

The lithium carbonate price chart has experienced significant volatility over the past decade, driven by fluctuations in supply and demand dynamics. Historically, prices saw a considerable surge from 2015 to 2018, primarily due to the rapid expansion of the electric vehicle market and a spike in demand for lithium-ion batteries. However, post-2018, the market witnessed a correction as new lithium mining projects came online, increasing supply and stabilizing prices.

Regional Price Variations

- Asia: Asia, particularly China, dominates the global lithium carbonate market. Prices in this region have been influenced by stringent environmental regulations, government subsidies for EVs, and fluctuations in raw material costs. China's central role in the global battery supply chain means its market trends significantly impact global prices.

- Europe: Europe's push towards green energy and stringent emissions regulations have driven a steady increase in lithium carbonate demand. This region has seen higher prices compared to other areas due to its reliance on imports and investment in battery production facilities.

- North America: The U.S. and Canada are emerging players in the lithium carbonate market, with recent investments in domestic lithium production. Price trends in North America are shaped by government policies aimed at reducing dependence on foreign imports and bolstering local supply chains.

- Latin America: This region, particularly the Lithium Triangle (Argentina, Bolivia, Chile), is rich in lithium resources. Despite the abundance of raw materials, prices have been subject to political instability, regulatory changes, and investment levels in extraction technologies.

- Middle East & Africa: These regions are relatively nascent markets for lithium carbonate but are witnessing growing interest due to strategic investments and diversification of economies. Price trends here are influenced by global market dynamics and emerging local initiatives.

Market Forecasts

Looking ahead, the lithium carbonate market is expected to maintain a growth trajectory, with prices forecasted to rise steadily over the next five years. This growth is fueled by:

- Rising Demand for Electric Vehicles: As governments worldwide implement policies to reduce carbon emissions, the adoption of electric vehicles is set to increase, driving up the demand for lithium-ion batteries.

- Advancements in Battery Technology: Innovations in battery technology, including increased energy density and reduced production costs, will boost the demand for lithium carbonate.

- Sustainable Energy Initiatives: The global shift towards renewable energy sources, such as solar and wind power, requires efficient energy storage solutions, further propelling the need for lithium carbonate.

Industrial Uses Impacting the Lithium Carbonate Price Trend

Battery Production

Lithium carbonate is a critical component in the production of lithium-ion batteries, which are essential for various applications:

- Electric Vehicles: The EV market is the primary driver of lithium carbonate demand. Major automotive manufacturers are investing heavily in EV production, which in turn escalates the need for lithium-ion batteries.

- Consumer Electronics: Lithium-ion batteries are ubiquitous in consumer electronics, including smartphones, laptops, and tablets. The continuous innovation and high turnover rate of these devices sustain a steady demand for lithium carbonate.

- Energy Storage Systems: As the world moves towards renewable energy sources, efficient energy storage systems are crucial for balancing supply and demand. Lithium-ion batteries play a vital role in grid storage solutions, bolstering the demand for lithium carbonate.

Glass and Ceramics

Lithium carbonate is also used in the glass and ceramics industry. It acts as a flux, lowering the melting temperature of silica and reducing energy consumption during the manufacturing process. The growth of construction and real estate sectors, especially in emerging economies, has a direct impact on the demand for glass and ceramics, thus influencing lithium carbonate prices.

Pharmaceuticals

In the pharmaceutical industry, lithium carbonate is used as a medication for bipolar disorder. Though the quantity used is relatively small compared to industrial applications, the pharmaceutical sector's demand can influence the overall market dynamics.

Lubricants

The production of high-performance greases for industrial and automotive applications often involves lithium carbonate. These greases are essential for machinery operating under extreme conditions, and their production growth parallels industrial expansion.

Air Treatment Systems

Lithium carbonate is used in air treatment systems to capture carbon dioxide and improve air quality in submarines and spacecraft. This niche application, while small in volume, represents a specialized demand segment influencing market trends.

Key Players

The global lithium carbonate market is highly competitive, with several key players driving innovation and production. Notable companies include:

- Albemarle Corporation: A leading player with a significant presence in the lithium carbonate market, Albemarle's operations span from mining to advanced materials production, ensuring a strong market position.

- SQM (Sociedad Química y Minera de Chile): One of the largest lithium producers globally, SQM benefits from its rich lithium reserves in the Atacama Desert, making it a critical supplier in the market.

- Ganfeng Lithium Co., Ltd.: As one of the world's leading lithium companies, Ganfeng Lithium has a comprehensive portfolio, including lithium extraction, refining, and recycling, positioning it as a key player in the market.

- Tianqi Lithium Industries Inc.: With extensive mining operations in Australia and processing facilities in China, Tianqi Lithium is a major contributor to the global lithium carbonate supply chain.

- Livent Corporation: Known for its innovative approaches in lithium production and processing, Livent focuses on high-quality lithium carbonate for diverse applications, including batteries and specialty polymers.

- Orocobre Limited: This Australian company, with operations in Argentina, has established itself as a significant player in the lithium market, particularly in the Lithium Triangle region.

These companies are continually investing in expanding their production capacities, advancing technologies, and securing long-term supply agreements, which collectively shape the market dynamics and influence lithium carbonate prices.

Conclusion

The lithium carbonate market is poised for sustained growth, driven by the burgeoning demand for electric vehicles, advancements in battery technology, and the global shift towards renewable energy sources. The regional variations in price trends highlight the complex interplay of supply chain dynamics, regulatory landscapes, and investment levels across different geographies.

Procurement Resource plays a crucial role in providing comprehensive market intelligence, helping stakeholders navigate the intricate landscape of lithium carbonate prices and trends. By offering detailed insights and accurate forecasts, Procurement Resource empowers businesses to make informed decisions, optimize their procurement strategies, and capitalize on emerging opportunities in the global lithium carbonate market.

In summary, the lithium carbonate market is at the forefront of the energy revolution, with its prices and trends reflecting the broader shifts towards sustainable and innovative energy solutions. As the market evolves, staying abreast of these developments is essential for stakeholders aiming to thrive in this dynamic industry.

Contact Us:

Company Name: Procurement Resource

Contact Person: Christeen Johnson

Email: [email protected]

Toll-Free Number: USA & Canada – Phone no: +1 307 363 1045 | UK – Phone no: +44 7537 132103 | Asia-Pacific (APAC) – Phone no: +91 1203185500

Address: 30 North Gould Street, Sheridan, WY 82801, USA